By David Servi

Shouts of jubilation, long and happy handshakes, a bone-crushing hug between partners, a leap in the air, a smack on the back that nearly knocked me over, a smile wider than the Harbour Bridge: all these were the heart-warming results of our remarkable streak of sales success here at Spencer & Servi since the beginning of the new financial year.

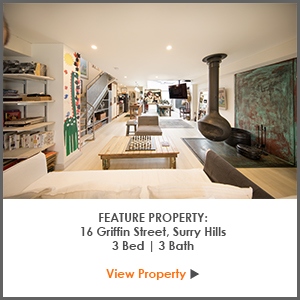

We have enjoyed these months of successful sales. The hammers coming down on record prices, the long negotiations coming to the best conclusions, the happy property-owners dancing in the streets. From a three-storey terrace in Redfern to an apartment in Edgecliff to a free-standing cottage in Surry Hills, and many, many others: all done and dusted, signed off and exchanged. And now, amongst many others on our books, a great property in Griffin Street, Surry Hills, with an opening roof and a hanging fireplace.

The Spencer & Servi team has been working to its strengths, making the calls, setting the dates, booking the advertising, talking to the prospective buyers, getting the legal details sorted out, prepping our wonderful auctioneer, making it all work. And it has worked, and we are all hugely pleased and proud of our efforts.

Journalists and politicians can talk all they like about Australia’s slowing real estate market. They can waffle on about the signs of cooling in the nation’s biggest housing markets (i.e. Sydney and Melbourne), and how restrictions on riskier bank lending are starting to bite and these measures are starting to reel in the runaway property market.

Cooling … sure, but not right here

And they have to be right … somewhere. But we can’t see it here in Sydney’s centre and the nearby suburbs. We haven’t felt any deceleration at all, and what seems to be the longest and steepest value increase in Sydney’s real estate history just keeps on giving. According to CoreLogic, the property information organisation, by the end of September the Sydney property market of houses and apartments was up by 10.54 per cent, year on year. Sure, it was down 0.13 per cent, month on month, but that’s a tiny proportion in the wider scheme of things.

Here on the ground, in Sydney’s inner-city, inner east and inner west, sales are still coming thick and fast for us. Our property-owners, some doubtful or depressed by the predictions and projections of a real-estate market meltdown, have been happy to find that their properties are worth just as much as they thought, and often more.

I can only say, from my many, many long years in real estate, that I have a great deal of confidence in the Sydney property market. Sure, there might be a hiccup here and there, but it always comes back bigger and brighter than ever. Think about any property you have a connection with, that was bought more than ten years ago … Doubled in value? Tripled? Quadrupled? Even if the current bull-rush slows, it will still move.

Australia’s Treasurer, Scott Morrison, appears to agree with me. In the US earlier this month he was extremely positive about Australia’s real estate market.

“While Australia's housing markets, especially in our largest cities, have experienced strong growth over the past decade this, of itself, is not evidence of an underlying weakness in housing asset values, nor that a hard landing for our housing markets is ahead”, he said.

Hear, hear.

in Latest News

Share This Post

Categories

Archived Posts

- February 2024 (1)

- January 2024 (2)

- October 2023 (2)

- September 2023 (1)

- August 2023 (3)

- July 2023 (2)

- September 2021 (1)

- August 2021 (3)

- November 2019 (1)

- October 2019 (4)

- February 2018 (1)

- January 2018 (1)

- December 2017 (3)

- November 2017 (1)

- October 2017 (2)

- September 2017 (4)

- August 2017 (4)

- July 2017 (2)

- June 2017 (1)

- May 2017 (1)

- April 2017 (1)

- March 2017 (1)

- February 2017 (1)

- January 2017 (2)

- December 2016 (2)

- November 2016 (1)

- September 2016 (1)

- July 2016 (1)